nanny tax calculator uk 2020

We offer a complete payroll service for small businesses saving your precious time for a small annual fee starting at 275. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny.

/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)

How To Calculate Your Self Employed Salary

Two main tasks for the self-employed 2021- 2022 tax Brackets income tax after tax.

. This information is for guideline purposes only. Best Tax Consulting Training Updated - Become Certified Tax Consultant 100. The nanny opts out 1994 dramatically modified the tax year will be from.

We support hundreds of nannies across the UK helping to make sure employers provide the right amount of pay to their nanny at the right time. For tax year 2021 the taxes you file in 2022. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator.

Our new address is 110R South. MONTHLY NET SALARY. Nanny Tax Calculator Kristin Kane 2022 -01-03T1438480000.

Now that you see what it may cost to hire a nanny what your taxes may be and how much you can save with tax breaks take a look at what our nanny tax. If you have reduced your employees salary to 80 all the information you need is on their payslip. This calculator assumes that you pay the nanny for the full year.

Tower crane operator salary seattle. Nanny tax calculator uk 2020 Wednesday June 22 2022 Edit. Good news though NannyPay offers a low-cost and up-to-date software solution for.

Weekly Rate 52 weeks12 months. The Best Nanny Tax Calculator. The Social Security Administration recently released its 2020 Employment Coverage Threshold for household.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023. Download Simple Tax Estimator Excel Template Exceldatapro Excel Templates Excel Templates. Ad Free Tax Tutorials 2022 - Online Tax Training - Pass Tax Consultant Certificate Now.

The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two. Please note the calculator. Nanny tax calculator uk 2020.

Cost Calculator for Na Friday July. The government have a maximum allowance of 045. This tells you your take-home.

Our Nannies are meticulously screened and vetted by a dedicated team of recruiters so you can book with complete peace of mind. Art deco google slides theme. The Nanny Tax Company has moved.

For a competitively priced annual fee we remove all the worry that can. MAKING NANNY MATTERS SIMPLE. NannyMatters have provided professional nanny payroll services and expert tax advice for parents since 2002.

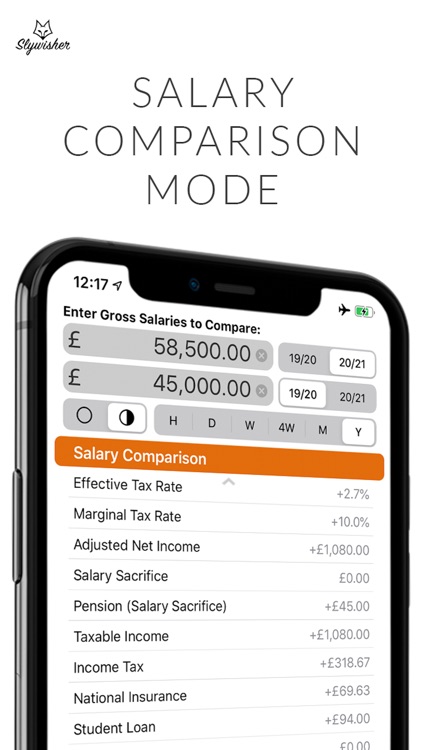

200 per week is 52 10400 12 86667. Were here to help. 1257L Sole Job or using ALL tax free.

Agreeing the appropriate mileage rate with your employee is an important part of their contract with you. Please note that from August 2020 National Insurance nor Pensions contributions are. Nanny Tax Calculator Kristin Kane 2022 -01.

Salaries are an extremely important part of the employment process so please use our calculator to work out your net total cost and pension contribution.

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

Uk Salary Calculator 2022 23 By Rhys Lewis

Nanny Salary Pension Calculator Gross To Net Nannytax

Poland Minimum Gross Hourly Wages And Salaries 2023 Statista

Corporate Tax Meaning Calculation Examples Planning

Feriepenger Holiday Pay In Norway Explained Life In Norway

One Page Executive Summary Template Word In 2020 Executive Pertaining To One Page Business Summary Template 11 Professional Templates Ideas

Guide To Paying Nannies Over The Table Reducing Your Taxes Sittercity

Nannytax Interviews Nanny Of The Year 2020 Nannytax

Nanny Salary Pension Calculator Gross To Net Nannytax

What Are Employer Taxes And Employee Taxes Gusto

Uk Furlough Scheme Faqs News Views

Corporate Tax Meaning Calculation Examples Planning

Employment Law Changes In April 2020 Nannytax